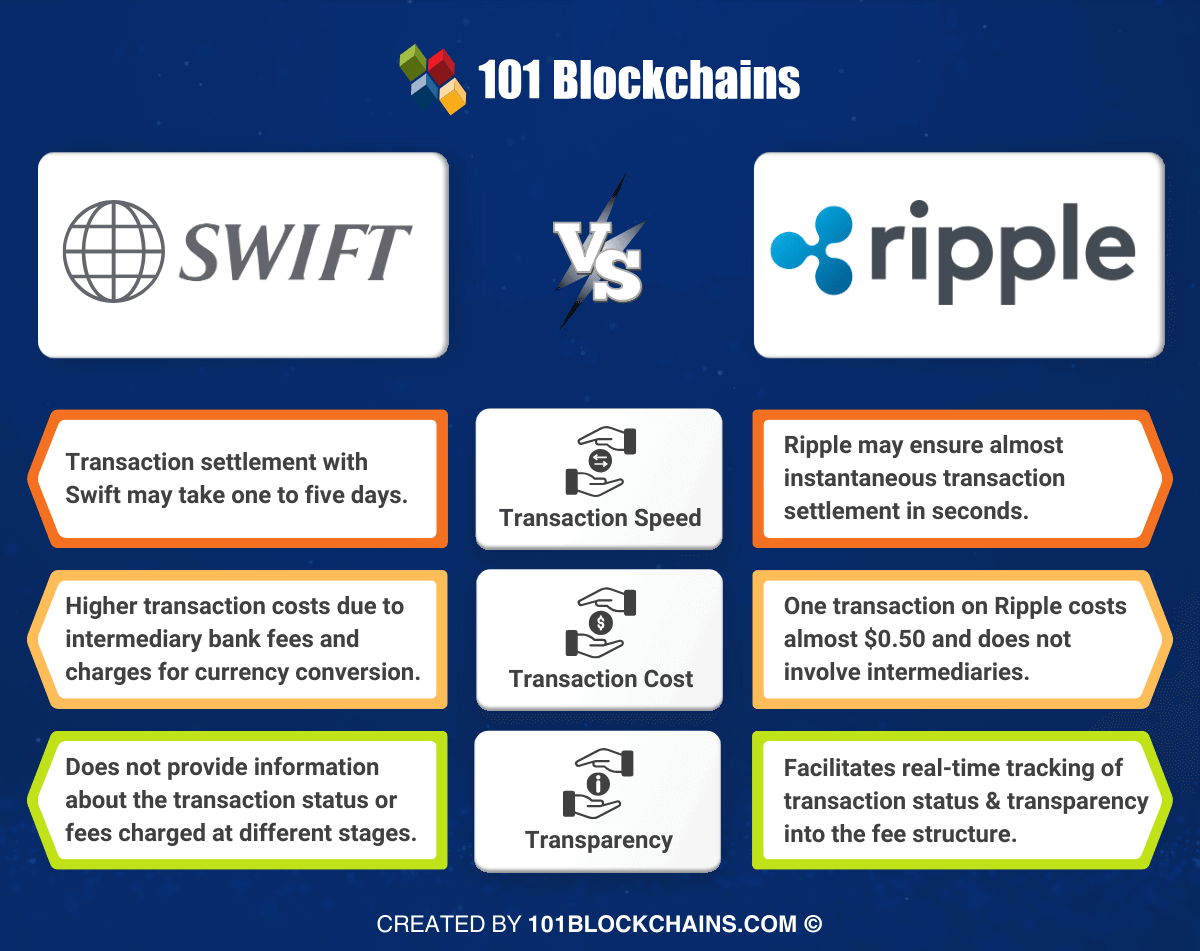

Cross-border payments or international payments are essential for global trade, investment and remittances. SWIFT has been one of the dominant players in the global payment landscape for many years. The Society for Worldwide Interbank Financial Telecommunication introduced innovation into the international payments sector to fight against challenges with traditional methods for cross-border payments. The Ripple vs. Swift debate has gained momentum in recent times with blockchain technology bringing in new alternatives like Ripple for improving cross-border payments. You must know that Ripple has emerged as a formidable contender of Swift for global payment dominance. Let us compare Ripple with Swift to find out whether it is a worthy contender or just another blockchain protocol. Build your identity as a certified blockchain expert with 101 Blockchains’ Blockchain Certifications designed to provide enhanced career prospects. Introduction to Swift as a Leader in Global Payments Before you compare Ripple with Swift, it is important to have a basic idea of what they are. Swift is a communication system tailored to help banks with cross-border transactions. Prior to the introduction of Swift, cross-border payments had to depend on manual processes and telex machines that slowed down transactions and increased the cost. Swift offered a reliable network that can enable secure communication between different banks all over the world. People are likely to raise doubts over questions like ‘Will Ripple XRP replace SWIFT?’ because Swift has developed a huge network over the years. The network started with around 239 banks and has expanded as one of the biggest financial networks. It operates in over 200 countries and territories with an impressive scale that connects more than 11,000 financial institutions worldwide. The notable financial institutions in the Swift network include clearing houses, asset management firms, securities brokers, corporate clients and banks. Swift also has leading global institutions as its members thereby implying that it manages a huge share of international financial transactions. As a popular standard for cross-border financial communications, Swift is a leader in global payments. Unraveling the Special Highlights in Working of Swift One of the common assumptions about the working mechanism of Swift is that it helps in transferring money between banks. It is important to know that Swift is a huge messaging network for financial institutions all over the world. The most important aspect in a Swift vs. Ripple comparison is the fact that Swift only transfers secure messages between banks and financial institutions. Let us assume that a customer submits a request for an international money transfer to their bank. The customer’s bank will initiate a SWIFT message featuring codes that only banks will understand and ensure faster transaction settlement. The message includes details about the sender, amount of money being sent, reason and currency. During the journey to the recipient bank, the SWIFT message will move through different intermediary banks when the sending and receiving banks don’t have direct relationship. The intermediary banks process the message and deduct their handling fees before moving the remaining balance to the next bank. The process will continue until the message or the funds reach the recipient bank. You can notice that SWIFT depends a lot on the network of correspondent banks spread throughout the world. The network obviously provides broader global coverage albeit with problems such as additional costs and delays. The complete process for cross-border fund transfer with Swift may take one to five business days. It is important to consider the processing efficiency of intermediary banks and the number of intermediary banks involved to determine the speed of transaction settlement with Swift. Start learning Blockchain with World’s first Blockchain Career Paths with quality resources tailored by industry experts Now! Role of Ripple as a Challenger against Swift in Global Payments Ripple might have been another blockchain protocol along the lines of Ethereum with generic features. On the contrary, the creators Ripple XRP had tailored it to serve efficient cross-border money transfers. The relationship between Ripple and Swift is visible in their primary goals that revolve around streamlining international payments. Ripple aims to elevate the efficiency of global payments by ensuring that they are cheaper, faster and more efficient. The XRP Ledger resolves the notable concerns of cost and speed in cross-border transactions that are noted in traditional systems like Swift. Ripple Labs has been successful in its efforts to revolutionize global payments. It has collaborated with some of the top banks and financial institutions to bridge the gap between blockchain and traditional finance. Some of the notable institutions that have collaborated with Ripple include American Express and Santander. Ripple has everything required to challenge Swift as it not only focuses on international payments but also on other subdomains in finance. It can help in ensuring faster payments in trade finance that will help exporters and importers with faster transaction settlement at lower costs. The scope for CBDC development with Ripple blockchain makes it a popular choice for transforming digital payments. Excited to learn the basic and advanced concepts of ethereum technology? Enroll now in the Ethereum Technology Course Exploring the Magic behind the Performance of Ripple The first thing that comes to mind when you hear about Ripple is blockchain technology. As a matter of fact, the biggest difference between Swift and Ripple is blockchain technology. Ripple blockchain enable direct cross-border payments rather than relying on involvement of multiple intermediary banks. The two most important components in the working of Ripple are the XRP Ledger and XRP token. The XRP Ledger is the decentralized blockchain network of Ripple while XRP token is the native cryptocurrency of XRP Ledger. XRP token stands out as a promising instrument for cross-border payments as it can serve as bridge between fiat currencies. Ripple uses a network of validators for confirming transactions alongside ensuring integrity and security of the system. Ripple does not depend on mining thereby ensuring faster transaction settlement and more sustainability. Cross-border payments are more efficient on Ripple blockchain as the algorithm finds the most effective path for payment transfer. The path could involve currency exchanges

Cardano’s Role in the Evolution of Smart Contracts

Smart contracts are one of the most prominent highlights of the blockchain and web3 landscape. The digital agreements embedded in code can enable automatic enforcement of contracts without trusted intermediaries. Ethereum has been the favorite blockchain platform for smart contract development for quite a long time. With the arrival of new players like Cardano, smart contracts have to go through some innovative changes. The use of Cardano in smart contracts development has witnessed explosive growth in 2024. The number of smart contracts on the network increased by ten times in a year thereby showcasing proof of its growing capabilities to support different types of dApps. Let us learn about the role of Cardano in transforming conventional approaches for creation of smart contracts. Build your identity as a certified blockchain expert with 101 Blockchains’ Blockchain Certifications designed to provide enhanced career prospects. Definition of Smart Contracts on Cardano Smart contracts work differently on Cardano as the blockchain uses the UTXO or Unspent Transaction Output model. The smart contracts on Cardano help in validating the transfer of UTXOs locked in a contract’s address. Users can lock UTXOs at the address of their script and can spend the UTXOs only if the script supports the transaction. You can also describe Cardano smart contracts as simple programs or validator scripts that allow users to define custom logic. Each Cardano node executes the scripts automatically during transaction validation. One of the notable highlights of smart contracts on Cardano is immutability as you cannot change them after deploying on the blockchain. Introducing New Changes in Smart Contract Design One of the foremost highlights about smart contracts on Cardano is the fundamental change in their design. As the number of smart contracts on Cardano increased by a huge margin within a year, experts believed that it showed the maturity of the blockchain platform. Developers have praised Cardano for introducing better prospects for scalability, an energy-efficient consensus mechanism and robust security features. The exponential growth in smart contracts deployed on Cardano suggests that it has become a strong challenger in DeFi and dApp development. You can notice the evolution of smart contracts with Cardano blockchain when you learn about their design. Smart contracts in Cardano have two distinct components, the on-chain and off-chain components. The on-chain component is the validator script or the code that defines the logic for the smart contract. The validator script helps in validation of each transaction containing value locked by the script and its compliance with contract rules. Cardano has created special tools and programming languages for creating validator scripts, thereby showcasing a completely different approach. The off-chain component is also a script or an application that can help you in generating transactions that follow the contract rules. You can create the off-chain component in almost any language. It is important to know that smart contracts on Cardano have to depend on the datum associated with a UTXO. The contract uses the datum as a part of the contract instance ‘state’ in future transactions. Without any datum on the UTXO in a contract address, the UTXO will remain locked forever. Want to understand the best ways to use DeFi development tools like Solidity, React, and Hardhat? Enroll now in DeFi Development Course! Technical Aspects of the Smart Contracts on Cardano Smart contracts are simple programs or pieces of code when you look at them from a theoretical perspective. In the case of Cardano, you may think that smart contracts are the validator scripts which specify rules that Cardano nodes will enforce when they validate transactions. The overview of smart contracts history will help you understand how Cardano has changed smart contracts with the validator scripts. You must know that the validator script has the permission to read the datum of the locked UTXO you want to move and the transaction context. The special feature of validator script design in Cardano supports the development of some complex contracts. Another notable highlight in the technical aspects of smart contracts on Cardano is the information used as arguments in validator scripts. The validator scripts in Cardano use three pieces of information, such as datum, context and redeemer as arguments. Datum represents the data associated with the output that will be locked by the script and it helps in carrying state. Redeemer is the piece of data associated with the spending input and generally helps in providing an input from the spender to the script. The context in validator scripts refers to the data which represents information about the spending transaction. It helps in making verifications about the approaches for sending an output. The unique design of smart contracts on Cardano also provides the advantage of creating multi-step contract workflows. It represents a new phase in the transformation of smart contracts by adding more steps to the basic workflow. You can use multi-step contract workflows for creating contracts that need multiple steps. One of the examples of multi-step contract workflow involves a contract that needs three different people to agree on the authority to claim the value locked in an instance. With the facility of creating multi-step contracts, Cardano has definitely created a new milestone in the history of smart contracts. Multiple Programming Languages for Smart Contracts on Cardano Another way to determine the impact of Cardano on the evolutionary transformation of smart contracts involves an overview of smart contract programming languages on Cardano. The Cardano blockchain introduced support for smart contract development in 2021. Over time, Cardano evolved into a multi-functional environment and now supports the creation and deployment of smart contracts with different programming languages. You can find multiple answers to ‘What language does Cardano use for smart contracts?’ as Cardano uses five programming languages. The five programming languages for smart contracts showcase the efforts of Cardano in driving transformative changes for smart contract development. Plutus Plutus is the ideal platform for the purpose of smart contract development and execution. It is a comprehensive platform for creating full applications that can interact with Cardano blockchain. Smart contracts

The Role of Ripple in Blockchain Adoption by Traditional Financial Institutions

Ripple Labs is a prominent name in the domain of blockchain technology that offers trusted solutions for CBDC development, stablecoins, cross-border payments and digital asset custody. You can discover that Ripple has been created with the objective of bridging the gap between traditional finance and blockchain technology. The impact of the Ripple blockchain on development of central bank digital currencies on a broader scale in different nations showcases a proof of its potential. Ripple has the potential to transform traditional finance and encourage blockchain adoption in banks and among payment service providers. Let us learn more about the capabilities of Ripple to encourage the adoption of blockchain in traditional financial institutions. Build your identity as a certified blockchain expert with 101 Blockchains’ Blockchain Certifications designed to provide enhanced career prospects. Clearing the Confusing Terminology of Ripple One of the first things that you are likely to come across while learning about Ripple is the confusion between Ripple and XRP. Many people claim that Ripple is the XRP Ledger while others claim that XRP is only the native token of Ripple. You must know that Ripple Labs is the creator of the XRP Ledger and XRP serves as the native token of the XRP Ledger. The XRP Ledger is the public blockchain that allows developers to create payment channels, dApps and cross-currency payment solutions. It is the same as other layer 1 blockchain networks such as Ethereum and Solana. XRP is the native token of XRP Ledger like ETH for the Ethereum network. The XRP token helps you pay for gas fees on the XRP Ledger. Ripple Labs is the creator of the XRP Ledger, thereby creating confusion about their terminology. Solutions by Ripple that Align with Traditional Finance Ripple is undoubtedly one of the biggest players in the domain of blockchain. You might wonder about the possibility of aligning Ripple with traditional finance as both of them are worlds apart. On the other hand, Ripple blockchain technology offers promising solutions that would gain traction among traditional financial institutions worldwide. Learning about the solutions offered by Ripple will help you determine how it will encourage blockchain adoption in traditional finance. The following solutions offered by Ripple will provide valuable insights on the potential of Ripple to promote blockchain adoption. Real-time Cross-Border Payments One of the foremost traits of Ripple that will make traditional financial institutions embrace blockchain is the assurance of real-time cross-border payments. International payments can be a challenging task as you may need days or even weeks for transaction settlement. Ripple can help financial institutions overcome conventional barriers and expand their payments volume. Traditional financial institutions can reach untapped corridors with real-time global payments thereby breaking traditional geographical barriers. The global network of Ripple, RippleNet, and its proprietary technology enable more reliable, affordable and faster cross-border payments. Banks and fintech firms emerging in traditional finance can capitalize on Ripple to discover new levels of productivity. Traditional finance companies are likely to choose Ripple for capitalizing on various advantages, including real-time settlement, global expansion and flexible payments. Financial institutions can leverage Ripple to achieve almost real-time transaction settlement for cross-border payments. The facility will be available on weekends and holidays that would enhance the abilities of traditional financial institutions to serve customers. The Ripple blockchain architecture also opens new opportunities for tapping into additional sources of liquidity and reducing foreign exchange costs. Ripple allows financial institutions to expand their reach in more than 80 markets for last mile payouts. The blockchain can help in reaching new customers without intensive resource requirements. Another important trait of Ripple that supports cross-border payments is the support of a transparent and compliant solution. Traditional financial institutions can use the solution to prioritize payment certainty alongside meeting regulatory requirements and global security standards. Digital Asset Custody Traditional financial institutions such as banks can explore new avenues for growth only through innovation. The ideal path to explore novel prospects for innovation involves learning about digital assets and using them to grow your reach. Financial institutions can leverage the Ripple solution for digital asset custody to create new revenues streams. It will also offer the foundation to achieve better customer retention with secure solutions for asset custody. Digital assets will gradually become an integral component of the modern financial services ecosystem and traditional finance companies will have to adopt digital assets. You can find answers to ‘what is Ripple in blockchain applications for banks and traditional finance’ in the advantages of custody solutions. Digital asset custody serves as a valuable factor for establishing new use cases in digital asset management, issuing stablecoins and asset tokenization. Ripple offers a self-custody technology that offers all the desired advantages of custody solutions. You can avail a broad range of functionalities to safeguard, manage and interact with digital assets with Ripple. Industry leaders choose the custody software of Ripple and show their trust in its blockchain technology. Some of the prominent advantages include security, efficiency, flexibility and advanced governance. The custody solution of Ripple offers bank-grade security alongside ensuring that it does not create obstacles for real-time execution. The self-custody solution also empowers traditional finance companies to achieve new efficiencies in back-office tasks. At the same time, the custody solution supports the automation or complete elimination of manual transactions and processes. Another notable benefit of the custody solution is the flexibility to choose any type of deployment. Companies can choose the customer-hosted, SaaS or hybrid deployment models along with the key management systems of their choice to deploy the custody software. It is also important to note that Ripple offers an advanced governance framework with its custody software. Finance companies can resolve operational challenges of clients and provide new value-added services alongside ensuring integration of custody in their tech stack as a core component. Arrival of a New Stablecoin The most promising highlight of Ripple that helps in understanding its role as a disruptor in traditional finance is the ability to issue stablecoins. The proprietary XRP Ledger of Ripple is capable of

Ripple’s XRP: A Deep Dive into Its Role in Blockchain and Financial Markets

Ripple Labs has been grabbing headlines for its unique efforts behind promoting CBDC development and cross-border payments. The most striking aspect of Ripple or the XRP Ledger is the capability to bridge the gap between cryptocurrencies and traditional finance. Interestingly, many people end up with confusion regarding answers to ‘What is Ripple XRP?’ as the terminology might be ambiguous. You must know that Ripple Labs is a company that has created the XRP Ledger, which is the decentralized ledger behind the Ripple blockchain. XRP is the native cryptocurrency for XRP Ledger and it serves different purposes. Let us learn more about the role of XRP in the broader blockchain and financial markets. Build your identity as a certified blockchain expert with 101 Blockchains’ Blockchain Certifications designed to provide enhanced career prospects. Unraveling the History of XRP The best approach to understand Ripple’s XRP involves a review of its history. You must know that the XRP Ledger came first in early 2012 when it had 100 billion XRP tokens. The company Ripple Labs was formed in September 2012 and took the decision to gift 80 billion XRP to self. What was the reason behind this decision? Ripple claimed that the gift was in exchange for the development of the Ripple ecosystem on the XRP Ledger. You can notice the dominance of XRP in blockchain landscape today as Ripple Labs promoted XRP in many ways. The company sold XRP on a regular basis and leveraged it to create stronger foundations for XRP markets. The XRP token has also helped in improving network liquidity alongside serving as incentives for development of the Ripple ecosystem. Ripple Labs took a revolutionary decision in 2017 by placing 55 billion XRP tokens in escrow. The primary goal of the initiative focused on ensuring that the amount of XRP tokens entering the general supply will grow without any speculations in the future. The XRP Market Performance site of Ripple provides reports on the amount of XRP tokens available and locked in escrow. Significance of XRP in the Ripple Blockchain As you learn more about the importance of the XRP token in the blockchain ecosystem, you must discover insights on its use cases in the XRP Ledger. XRP is the native token of XRP Ledger or Ripple blockchain just like Ether for the Ethereum blockchain. Any Ripple XRP guide will help you discover that XRP plays a major role in facilitating transactions on Ripple blockchain. It also helps in ensuring security of the XRP Ledger and as a pair for currency bridging in the native DEX of the XRP Ledger. As of now, XRP has helped in driving transactions that represent more than $1 trillion in terms of value exchanged between different parties. The XRP token was created with the sole objective of serving as a digital currency for payments. XRP was tailored to be better than Bitcoin with faster transaction speed, enhanced sustainability and higher cost-efficiency. The XRP token takes only 3 to 5 seconds for transaction settlement while BTC needs 500 seconds. The cost of each XRP transaction is around $0.0002 while BTC transactions might cost $0.50. One of the most interesting aspects of XRP that makes it better than Bitcoin is the negligible energy consumption. On top of it, XRP offers better scalability than Bitcoin with the capability to process 1500 transactions per second. You can notice that XRP has created some unique milestones in the blockchain landscape by introducing some promising advantages. Ripple Labs has ensured that XRP outperforms other top blockchain networks in terms of speed, cost, scalability and sustainability. It will establish a precedent for development of other innovative blockchain protocols with better benefits. The impact of XRP on the blockchain landscape will be visible in the long run with the arrival of more efficient blockchain protocols. Discovering the Role of XRP in the Domain of Finance XRP has gained popularity as a trusted instrument for financial institutions that need cross-border payment solutions. Over time, Ripple Labs has joined hands with many financial institutions worldwide and expanded its network. The dedicated network for banks and financial institutions, RippleNet, has proved to be a crucial element in bridging the gap between blockchain and traditional finance. You can understand the importance of XRP in financial market from the fact that you can send it directly without central intermediaries. It also offers the flexibility for exchange on the open market and uses in real-world scenarios that would enable cross-border payments. Financial institutions can use XRP as a bridge currency to ensure more affordable and faster international payments worldwide. Individual consumers can also leverage XRP to transfer different types of currencies all over the world. The best example to showcase the potential of XRP in the domain of finance focuses on its use cases in trading. The XRP token is available for trading in over 100 markets and exchanges all over the world. With the assurance of high-speed transfers, low transaction fees and better reliability, XRP is a valuable option for traders. XRP can serve as a reliable, cost-effective and high-speed digital asset that traders can use as collateral for trading activities. Traders can leverage XRP to seize arbitrage opportunities, manage general trading inventory in real time and service margin calls. The XRP ecosystem allows traders to bridge currencies, switch between cryptocurrencies instantly and shift collateral on any exchange. The use cases of XRP in trading provide a clear impression of the ways in which XRP can revolutionize financial markets worldwide. Impact of the Growth of XRP on Crypto Wallets and Banking Platforms The rise of XRP will have a formidable impact on cryptocurrency wallets and crypto banking platforms in many ways. Growing adoption of XRP will affect the development of crypto wallets and banking platforms. The increase in number of active wallets on XRP Ledger will encourage more wallet developers to offer support for XRP. It will lead to the development of custom wallets that align with the needs of XRP users. At the same time, wallet

Is Ripple the Next Big Thing in DeFi?

Ripple is one of the notable names that has been thrown around a lot in discussions about the crypto space. It is a popular technology company that has created the XRP Ledger, a public blockchain and XRP, the native cryptocurrency of the blockchain. While news headlines talk about Ripple prediction for the next day, Ripple Labs has been actively involved in various initiatives. For starters, Ripple has collaborated with governments of five nations with many others in line for creating CBDC pilots. Ripple offers trusted blockchain and tokenization solutions tailored for digital asset custody, CBDCs, stablecoins and cross-border payments. Let us find out how Ripple is positioned to become the next big thing in DeFi. Build your identity as a certified blockchain expert with 101 Blockchains’ Blockchain Certifications designed to provide enhanced career prospects. Understanding the Involvement of Ripple with DeFi Ripple has become one of the leading contenders to become a big player in the domain of decentralized finance. It has a crucial role in promoting DeFi with the facility of important tools and infrastructure required to develop new DeFi projects. You can notice that the XRP Ledger and the Ripple Transaction Protocol or RTXP have served as building blocks for various DeFi applications. Supporters of Ripple claim that the platform has been a prominent contributor to the growth of the DeFi ecosystem. Ripple Protocols that Support DeFi Ripple relies on the Ripple Transaction Protocol and the Ripple Protocol Consensus Algorithm for transferring fiat currency and digital currency across borders. The protocols serve a distinct role in providing cost-effective and faster cross-border payments. You can find clear answers to ‘What is a DeFi in Ripple?’ by exploring the functionalities of the Ripple Transaction Protocol. It is an open-source protocol that uses the XRP ledger to support cross-border payments. The RTXP protocol serves a unique consensus mechanism, IOUs, pathfinding algorithm and gateways. IOUs represent the debt obligations between gateways and users and help in facilitating transactions. Gateways are the reliable currency exchange entities that serve as entry and exit points for transactions in the Ripple network. The Ripple Protocol Consensus Algorithm is a consensus process that uses the design of Practical Byzantine Fault Tolerance algorithm. Nodes in the Ripple network that participate in the consensus process are validators. Validators should hold a specific amount of XRP tokens as security deposit in the network. It offers a more secure and lightweight consensus mechanism that can support DeFi operations. The most promising protocol of Ripple that will have a crucial role in developing DeFi solutions is the Interledger Protocol or ILP. It is an open-source protocol that empowers transactions between different ledgers and payment networks. ILP leverages different components such as connectors, conditional payments, cryptographic unlocking mechanism and routing protocol. The components help in ensuring interoperable, secure and efficient transactions between different payment systems, thereby serving as the ideal option for DeFi. Want to explore in-depth about DeFi protocol and its use cases? Enroll now in the DeFi Intermediate Level Course Unraveling the Reasons to Pursue DeFi Development on Ripple DeFi developers are likely to trust the Ripple blockchain for DeFi development as it offers different appealing advantages. An overview of the reasons for which developers select the XRP ledger for DeFi projects can help you understand how Ripple will be the next big thing in DeFi. The XRP ledger is public and decentralized with the open-source capabilities allowing anyone to build on the ledger. The ledger is maintained by the Ripple community that provides support to DeFi developers. Companies, validators, users and developers in the Ripple community work together to enhance the XRP Ledger for DeFi. Another promising trait of Ripple that supports DeFi development is the assurance of streamlined development. You can notice how the XRP ledger encourages innovation with multiple projects emerging in the Ripple ecosystem. On top of it, Ripple also provides different tools along with documentation that simplify development and reduce time to market. The most interesting reason to build DeFi projects on the XRP Ledger of Ripple is the assurance of better performance. Ripple has gained significant popularity for faster transaction settlement within seconds. The transaction speed of Ripple is one of the reasons for which it is the popular choice for cross-border payments. Enroll now in the DeFi Development Course to understand the best ways to use DeFi development tools like Solidity, React, and Hardhat. Discovering the Utility of XRP Ledger in DeFi Development The XRP Ledger provides tools and targeted innovations that speed up development and help in reducing time to market. It can serve as a valuable platform for creating a diverse range of DeFi solutions. You must know about the notable tools offered by the XRP Ledger to support DeFi development. The tools on XRP Ledger are classified into two categories, infrastructure and developer tooling. The infrastructure tools provide the basic foundation for creating DeFi solutions while developer tools help in adding distinctive functionalities. Infrastructure Tools on XRP Ledger You can notice the DeFi Ripple connection clearly in the different infrastructure tools available on the XRP Ledger. The infrastructure tools such as Bithomp, Gatehub, XRP Toolkit, XRPL.org Ledger Explorer, OnTheDex, XRPL Rosetta, Towo Labs and XRPScan. Each tool serves distinct functionalities that can help you create efficient DeFi applications with Ripple. Bithomp is a specialized XRPL explorer and toolkit employed in different cryptocurrency exchanges. It was created in 2015 with the objective of offering a user-friendly XRPL explorer. Gatehub is also another explorer tailored for the XRP Ledger. It helps in tracking the issuances of Gatehub on the XRP Ledger. XRP Toolkit offers a dedicated platform to manage crypto assets and trading activities on the decentralized exchange of XRP Ledger. XRPL.org Ledger Explorer is the preferred block explorer for the XRP Ledger that can offer transparency into the DeFi apps. OnTheDex serves as a trusted source of information on live feeds of XRPL token activity. It provides the information about XRPL token activity to other aggregator sites. XRPL Rosetta offers a promising infrastructure tool to create

The Future of Blockchain Technology in 2025: Trends, Innovations, and Opportunities

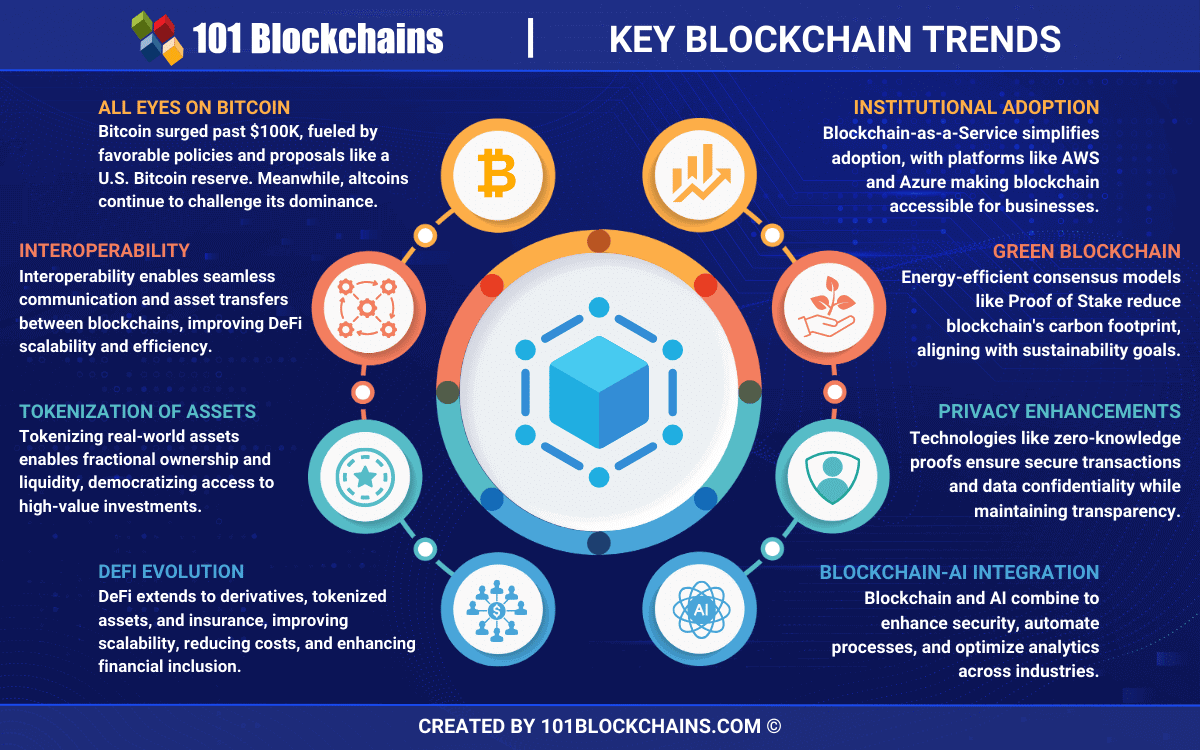

Blockchain technology has revolutionized the digital landscape with innovative advancements since its inception. Starting from cryptocurrencies to DeFi apps, blockchain has introduced many new trends, innovations and opportunities every year. The search for opportunities in blockchain with a review of trends can guide you to the best ways to use blockchain technology. The upcoming trends in blockchain will focus on introducing novel solutions and enhancing user experience. You can also expect new technological advancements to make their way into the blockchain landscape in future. Let us discover the notable trends that will have a significant impact on the future of the blockchain industry. Build your identity as a certified blockchain expert with 101 Blockchains’ Blockchain Certifications designed to provide enhanced career prospects. Reasons to Learn about Blockchain Trends Some people might have doubts regarding the need to know about blockchain trends. The potential of blockchain as a futuristic technology is one of the reasons to stay updated with latest events in the blockchain landscape. You might miss the next big innovation in a specific industry like gaming or financial services by skipping popular blockchain trends. Awareness of blockchain trends also help you learn about blockchain technology innovations that will help users and developers. Blockchain trends also provide an explanation for the possible direction of blockchain technology in the future. Most important of all, knowledge of latest trends in the blockchain landscape can help you make informed decisions about crypto investments and dApp projects. Which Trends Will Dominate the Blockchain Landscape in 2025? The discussions about trends that will have a significant influence on the blockchain industry draw the limelight towards new technologies, evolution of decentralized finance, enhanced interoperability solutions and CBDC adoption. You can explore novel opportunities to capitalize on the power of blockchain technology by using information about prominent blockchain trends. The emerging trends in blockchain will pave the way for a decentralized, interconnected and more sustainable future. The following influential trends will reshape industries and create new possibilities to transform the digital landscape. All Eyes on Bitcoin The ongoing Crypto Bull Run and events favoring Bitcoin have pushed the world’s first cryptocurrency to its all-time peak. Bitcoin crossed the $100,000 mark in December 2024, following the victory of Donald Trump in the Presidential elections. The promises of Trump during his election campaign aligned in support of cryptocurrencies that indicate possibilities of good times for Bitcoin. The biggest news in favor of Bitcoin is the national Bitcoin reserve proposed by a Republican Senator in the United States. Bitcoin will serve as a hedge against currency devaluation, inflation and geopolitical risk according to the proposal for the Bitcoin reserve. The strategic Bitcoin reserve will be created by purchasing 200,000 Bitcoin every year to accumulate one million tokens. Proponents of the Bitcoin reserve suggest that it will help in reducing financial deficit without increasing taxes. Some supporters also believe that the Bitcoin reserve will help in reducing the debt of United States by half in almost 20 years. At the same time, it is also important to keep an eye on the potential rise of altcoins as competitors of Bitcoin for dominance over the crypto market. Interoperability Becomes a Priority The future of blockchain technology also depends a lot on interoperability between different blockchain platforms. Interoperability will be one of the top priorities in the blockchain landscape to enable seamless asset transfers and data exchange between blockchain networks. The demand for interoperability will lead to a robust blockchain ecosystem with interconnected platforms thereby ensuring enhancements in efficiency and scalability. Interoperability with cross-chain solutions can enable collaboration between different networks such as Ethereum, Solana, Arbitrum and Polkadot. Some of the notable projects that promote interoperability include Polkadot and Cosmos. The two blockchain platforms offer unified ecosystems and shared communication protocols to ensure interoperability. The focus on interoperability will also help in creating novel solutions for DeFi that improve overall system scalability. Enroll now in the Blockchain Scalability and Interoperability Mastery Course to learn the skills needed to develop faster, scalable, robust, and interoperable dApps. Tokenization of Real World Assets Real world assets or RWA is another popular trend that will affect the future of blockchain industry. Tokenization of physical assets provides the opportunity to capitalize on various advantages such as fractional ownership and increased liquidity. Real world assets for tokenization can be anything in the physical world, such as real estate or precious metals. Blockchain will promote tokenization of assets in the real world and enable trading of tokenized assets on secondary markets. It can improve liquidity alongside reducing the financial barriers to accessibility of specific assets. The benefit of fractional ownership with tokenized real world assets can help multiple investors in sharing the ownership of high-value assets. Evolution of Decentralized Finance Decentralized finance will also go through some major changes as part of some notable trends. It is important to note that the role of DeFi in blockchain future will not revolve solely around lending and borrowing protocols. As the blockchain landscape grows bigger, DeFi plans on introducing more complex financial instruments such as tokenized assets, derivatives and insurance. The biggest strength of DeFi focuses on achieving better financial inclusion, particularly for the unbanked population. It is important to note that the evolved DeFi will address the problems of scalability and high transaction costs. You can expect a more secure, efficient and accessible DeFi with improved user experiences and lower barriers to entry. One of the notable examples of the evolution of DeFi is evident in the liquidity pools of Aave protocol that offer staking solutions for under-collateralized loans. Enroll now in the DeFi Development Course to understand the best ways to use DeFi development tools like Solidity, React, and Hardhat. Institutional Adoption of Blockchain Technology The list of prominent trends in the blockchain landscape for 2025 will be incomplete without highlighting institutional adoption of blockchain. You can expect sporadic growth in the number of Blockchain-as-a-Service solutions in future. Businesses of all sizes can leverage the BaaS model for deploying blockchain protocols. The Blockchain-as-a-Service